cars laws low-cost auto insurance low cost

cars laws low-cost auto insurance low cost

While raising your deductible will reduce your costs, there are various other results to take into consideration for your auto insurance coverage expenses. Let's take a look at all the factors you need to consider when picking your auto insurance policy deductible!

If you weren't called for to have an insurance deductible, you might practically have as many accidents as you desired on the insurance provider's cent. Paying an insurance deductible guarantees you likewise have a risk in any cases you make. Deductibles generally just relate to harm to your own property, like whens it comes to detailed and also collision car insurance policy – cars.

What is the relationship between the deductible as well as costs? Frequently, a lower deductible methods greater regular monthly repayments. If you have a low insurance deductible, you have much more insurance coverage from your insurance firm and also you need to pay much less out of pocket when it comes to a claim. A higher insurance deductible suggests a lowered expense in your insurance coverage costs.

A low deductible of $500 implies your insurer is covering you for $4,500. A higher insurance deductible of $1,000 means your company would after that be covering you for just $4,000. Because a reduced deductible relates to more insurance coverage, you'll need to pay more in your monthly premiums to balance out this increased insurance coverage – cheap.

Little Known Questions About What Is A Deductible? – Belairdirect Blog.

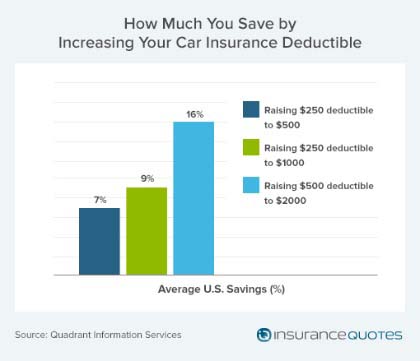

This was reliant upon the state, though, where Michigan just saved 4% for the deductible raising while Massachusetts saved a standard of 17% (cheaper cars). However some people make the mistake of choosing the greatest deductible simply to save money on their premium. When it comes to an incident, however, having a high insurance deductible could have severe economic consequences.

If you have that money available at any point, it could be worth choosing a higher insurance deductible. 2. What is the payback? Do the math with your insurance policy representative. Just how much would you conserve on a lower premium if you had a greater deductible? Would you conserve cash that would correspond to that deductible when it comes to a case? As an example, allows state that transforming from a $500 to $1,000 deductible would conserve you 10% on your annual costs.

Currently you have an increased deductible by $500, but you are conserving $80 per year. If you don't obtain into a crash in those 6 years, the enhanced deductible was worth it.

If you have an excellent driving document, a greater deductible might operate in your support. You'll conserve money on the premiums, which you could utilize towards your insurance deductible in the situation of an insurance claim. For instance, a chauffeur that hasn't had a crash in two decades may not be terrified by the above example of the 6-year period to comprise the difference – vans.

3 Simple Techniques For Deductibles For Automobile Physical Damage Insurance Policies

4. Just how risk averse are you? Inevitably, a greater insurance deductible is a greater danger. The reduced your insurance deductible, the extra coverage and security you have. Just how much are you and your family members going to run the risk of? 5. What is the worth of your lorry? Expensive cars cost even more to guarantee. In this case, a high insurance deductible could make feeling since you would certainly have higher savings on your costs.

People that are leasing or funding their auto tend to select a lower deductible. If you don't get in a great deal of accidents, you can take the threat with a greater deductible. To keep it easy, you might want to hold the same deductible for all types of protection and autos.

There are various other means to reduce your costs, like going shopping around and packing your car as well as house insurance. Click below to discover regarding the 16 ways to lower your car insurance policy costs. If you couldn't pay for to make your insurance deductible tomorrow, you require a reduced insurance deductible. If you're an excellent motorist with a high resistance for risk, you can elevate your insurance deductible.

The 8-Minute Rule for How To Have Your Auto Insurance Deductible Waived

What is the difference between a deductible and also a costs? A costs is the amount of money that you would certainly pay your insurer in order to keep your plan energetic. Unlike an insurance deductible, your costs is normally paid on a regular monthly, yearly, or semi-annual basis. Your deductible and also your premium go hand-in-hand; if one is higher, than the other will be lower as an outcome.

Will enhancing my deductible really conserve me cash? The brief and also easy answer to this inquiry is of course; if you boost your insurance deductible, you will certainly save money on your costs.

If your deductible is exceptionally high, You will be in charge of paying it in complete every single time a claim happens. Having a high insurance deductible could additionally adversely affect you in case of filing a small claim. If the price of damages you are filing for are much less than the expense of your insurance deductible, it will make no feeling for you to also file the insurance claim. auto.

If you have a sufficient Helpful site quantity of cost savings to pay a large amount at one time, than it might be worth selecting a greater insurance deductible (cheaper). Otherwise, after that you will possibly be far better off with a lower insurance deductible to ensure you will not be left in any type of type of monetary bind.

8 Easy Facts About What Is A Disappearing Deductible? – Mapfre Insurance Explained

If you live in a city that has a large volume of little crashes as a result of heavy traffic, after that a reduced insurance deductible is most likely your ideal alternative as you might be more likely to obtain into a mishap than a person living in a reduced populated area. cheap car insurance.

This is so you won't have to pay out such a large sum each time that you make a case. If you have a really clean driving record, having a greater deductible could be beneficial for you. Verdict: You have choices Deciding what cost to establish your insurance deductible at can be a tough decision.

perks vehicle insurance car insured auto insurance

perks vehicle insurance car insured auto insurance

Have even more concerns regarding your insurance deductible, premium or various other protection options? Contact us with one of our licensed insurance policy specialists today (cheap insurance).

car insured vehicle cheap car low cost auto

car insured vehicle cheap car low cost auto

car insurance low-cost auto insurance affordable auto insurance vehicle insurance

car insurance low-cost auto insurance affordable auto insurance vehicle insurance

The policy costs is the price you will certainly pay to an insurance business for providing the plan insurance coverages as well as attributes noted in the plan – auto insurance. This is a recurring cost to keep the policy, although it will likely alter at your renewal duration based on the company's updated prices as well as your individual metrics.

Examine This Report about What Is An Auto Insurance Deductible? How Does It Work …

Your insurance policy deductible quantity is something you will certainly establish with your insurance coverage agent or provider before settling your vehicle insurance plan. You ought to have the option to alter your insurance deductible at any kind of time. What kinds of automobile insurance coverage deductibles are there? Your vehicle insurance plan is a bundle of various insurance coverages. cheaper cars.

Other protections such as extensive, collision, personal injury defense and also without insurance vehicle driver building damages exist to aid cover injuries to those in your car and damage to your car. These insurance coverages might have deductibles, or at the very least the choice to include a deductible to decrease the expense of protection – perks.

g., telephone post, guard rail, mail box, structure) when you are at-fault. While collision protection will not reimburse you for mechanical failing or regular wear-and-tear on your cars and truck, it will certainly cover damages from craters or from rolling your lorry. The average price of collision protection is commonly around $300 each year, according to the Insurance policy Information Institute (Triple-I) – automobile.

ComprehensiveOptional comprehensive protection supplies security against burglary and damage to your lorry brought on by an event aside from a collision. This consists of fire, flood, vandalism, hail storm, falling rocks or trees and also other threats, such as striking a pet. According to the Triple-I, the average expense of comprehensive protection is generally much less than $200 per year.

Some Known Questions About Do I Pay A Deductible If I Hit A Car? – Clearsurance.

This coverage is not available in every state, yet it may have a state-mandated deductible amount in those where it is. In the events where a deductible applies, it is generally low, between $100 to $300. Injury security, Depending upon your state, you may have accident security (PIP) coverage on your policy.

It can additionally aid cover costs associated to shed wages or if you need someone to do household jobs after a mishap because you can refrain from doing so. Depending on your state, you might have a deductible that uses if suing under this insurance coverage. car insured. Lots of states with PIP deductibles provide a number of options to pick from, and also the insurance deductible you choose can influence your costs.

The majority of companies supply choices for $250, $500, $1,000 or $2,000 deductibles. Some car insurer supply different alternatives for deductibles, consisting of a $0 or $100 deductible. Your thorough and accident protections do not have to match, either; it is not unusual to have a $100 detailed insurance deductible yet a $500 crash deductible, or a $500 extensive insurance deductible as well as $1,000 collision deductible.

Normally, the lower the deductible, the greater your insurance costs. It is necessary to consider your general monetary health and wellness when picking an insurance deductible. Factors to consider when picking a vehicle insurance deductible, There are several points to think about when choosing your automobile insurance deductible amount. We have covered several of them here: Do you intend to pay much less for automobile insurance policy or repair services? A greater deductible will normally lower your insurance premium, but you will certainly pay greater out-of-pocket prices if you sue for damage to your lorry.

Some Known Incorrect Statements About What You Need To Know About Your Car Insurance Deductible

You might invest more on your costs by having a lower insurance deductible as well as never ever end up submitting an insurance claim. This is the nature of having insurance coverage as well as an example of the risk both you and also the insurer tackle. Exactly how much can you afford to pay out of pocket? Prior to you pick an insurance deductible, it is essential to find out what you can afford to pay if your car is damaged in a mishap.

If you do, you may not be able to manage to fix your automobile if you are at mistake as well as require to pay the insurance deductible for repairs. Does your lender have insurance deductible needs? If your automobile is financed or rented, you will possibly require to lug detailed and also accident protections for your automobile. cheaper auto insurance.

affordable auto insurance auto insurance cheap car cheaper auto insurance

affordable auto insurance auto insurance cheap car cheaper auto insurance

Some lending institutions will certainly have an optimum insurance deductible that you are enabled to lug for thorough and also accident. It is very important to contact the banks that manages your car loan or lease to identify if these limitations exist (automobile). When are you not called for to pay your car insurance deductible? There will be occasions when you are not needed to pay your insurance deductible, yet those are rare.

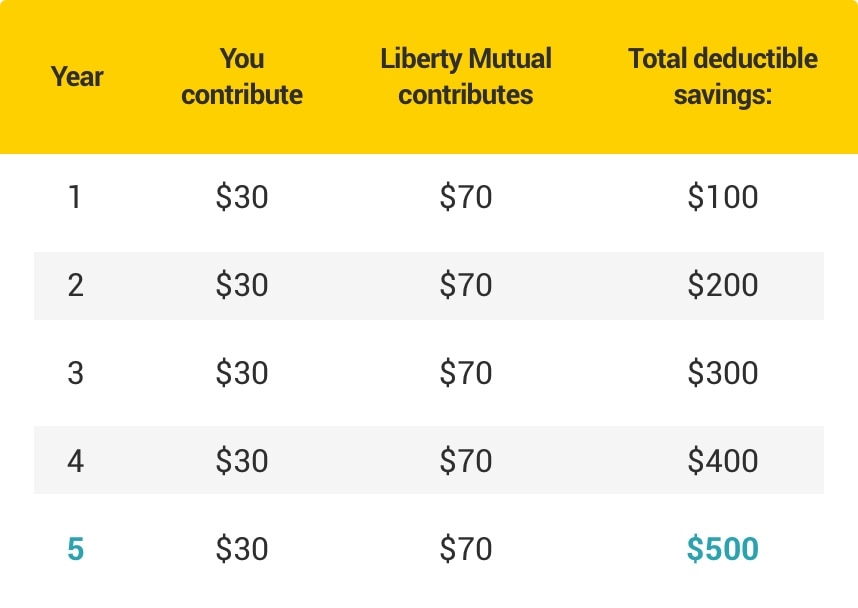

Your deductibles only use when suing with your insurance company (risks). If you have a reducing deductible, Some insurance coverage firms provide a diminishing deductible, or vanishing insurance deductible, alternative. If you have this policy attribute, the longer you go without a mishap results in a decrease in the quantity you would need to pay for your deductible.

8 Simple Techniques For Comprehensive Coverage – Auto Insurance

So, for instance, if you have a $500 accident insurance deductible and also do not have an accident for four years, you can obtain a $100 reduction annually. Then, if you required to submit a claim, your deductible would be $100 rather than the initial $500. Once you use your decreasing deductible, there is generally an amount of time to get it once more

Leave a comment